LOCATION-BASED INTELLIGENCE

Integrated data, maps, and analytics for the modern ag lender

Agricultural Lending Has Changed Forever

Extreme weather puts loan assets at risk. New generations of farmers and tech-inclined competitors are changing the playing field. Tightening reporting standards make it more crucial than ever for lenders to assess risk efficiently. However, hard-to-get data and separated financial tools make it difficult to support a modern lending experience.

SIGN UP FOR A DEMO

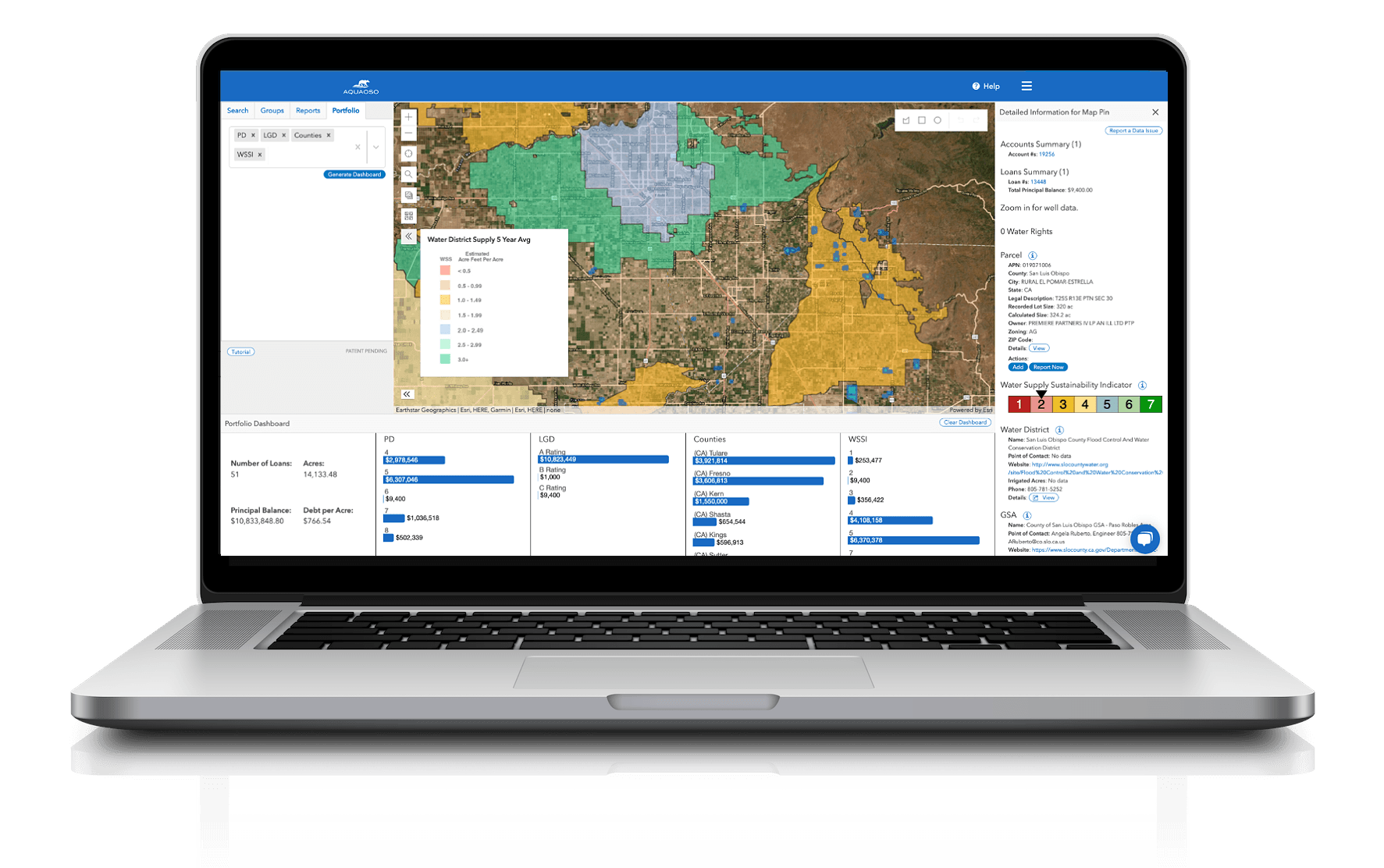

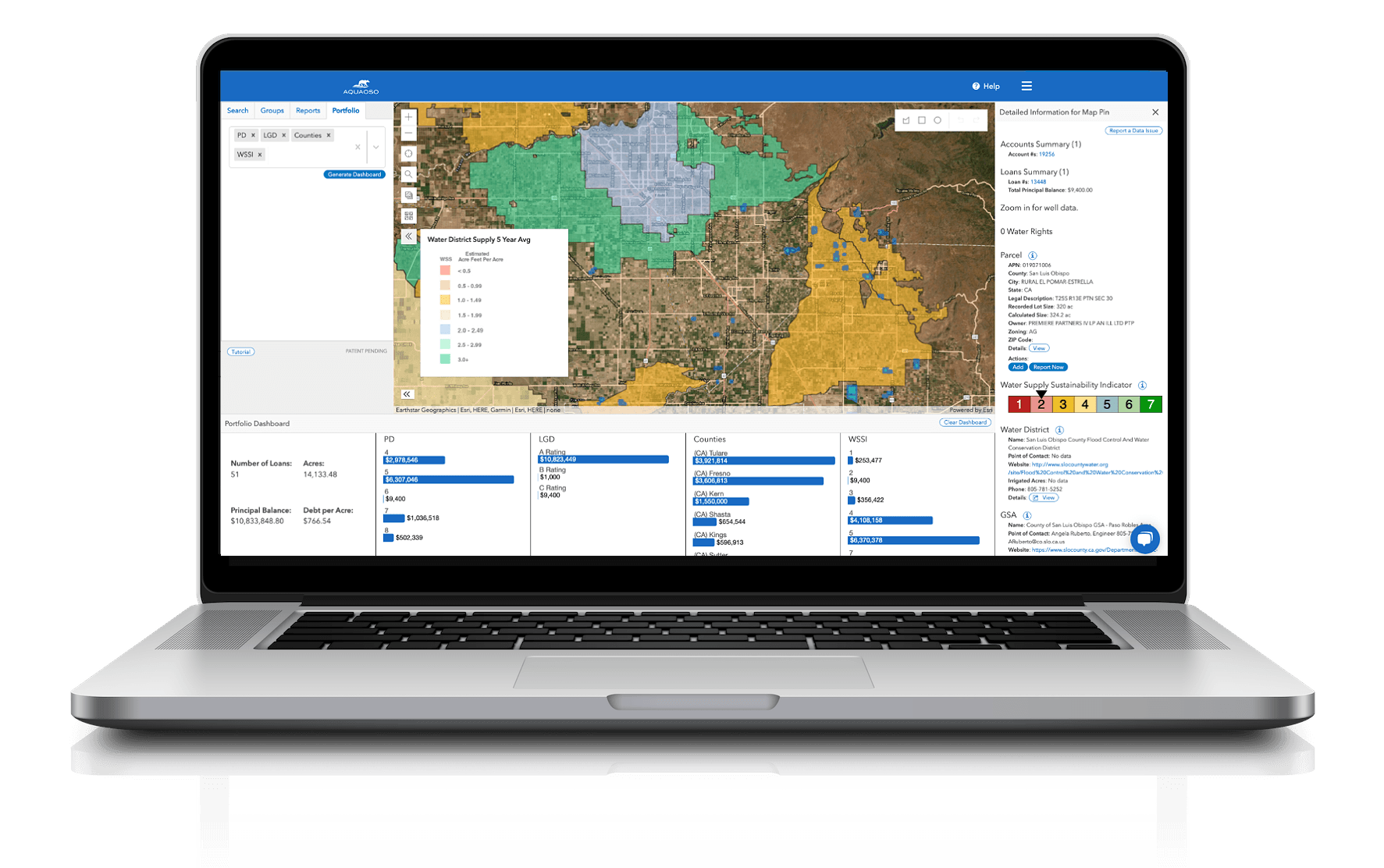

Location-based Intelligence Powers Modern Ag Lending

Future-proof your lending operations. Build deeper relationships with your borrowers by using location-based intelligence to better understand how climate events impact their operations. See your data and risk clearly on a map, easily generate comprehensive reports for your regulators, and streamline loan processes and due diligence.

GIS Connect is Proven and PURPOSE-BUILT

FOR AG LENDERS

Benefits

GIS Connect adds the power of location to your financial data and layers it with best-in-class third-party data sets, including land, field, climate, weather, and more. Our data library is ever-growing and is directed by our customers’ requests.

ANALYTICS

Surface meaningful insights into your portfolio

Integrated Data

Securely unify important datasets to provide a holistic view

Reporting

Quickly generate required documentation and artifacts

Mapping

Unlock powerful insights through location-based intelligence

Alerting

Strengthen relationships with event-impacted borrowers and mitigate risk

Climate Stress Testing

Understand your risk exposure, from parcel to portfolio

Our Customers’ Success Is Our Success

We can’t wait to celebrate yours…

“Using AQUAOSO has helped me cut down on research time and has provided me more water information than ever before! It is now the first step in my loan underwriting process and it has allowed me to devote more time toward expanding our loan portfolio.“

“I have been continually impressed with the commitment to customer service. We use the Mapping and Research Tool and at our request AQUAOSO expanded the information covered in their reports. This eliminated the need to visit multiple websites to gather information and we’ve been happy with the result!“

“The data management platform has turned what used to be a month’s worth of manual data gathering into minutes of using the platform. This has sped up my investment operations and data management while helping me stay competitive in today’s digitizing landscape.”

from parcel to portfolio

Loan and farm-level data roll up into a powerful portfolio-level view. Experience new insights and value at every level.

Relationship Managers

Prioritize on-site visits with insights and data on properties belonging to borrowers or prospects

Appraisers

Save time and money with parcel-level environmental details and comparable sales

Credit Risk Officers

Supercharge due diligence by comparing borrower operations with a wide range of risk data

Enterprise Risk Managers

Harness portfolio-level analysis and alerts to gain objective data for initiatives such as CECL

Executives

Easily report to your board with visually appealing, at-a-glance answers on portfolio-level risk

from parcel to portfolio

Loan and farm-level data roll up into a powerful portfolio-level view. Experience new insights and value at every level.

Relationship Managers

Prioritize on-site visits with insights on properties belonging to borrowers or prospects

Appraisers

Save time and money with parcel-level environmental details and comparable sales

Credit Risk Officers

Supercharge due diligence by comparing borrower operations with a wide range of risk data layers

Enterprise Risk Managers

Harness portfolio-level analysis and alerts to gain objective data for initiatives such as CECL

Executives

Easily report to your board with visually appealing, at-a-glance answers on portfolio-level risk

See it in Action

Ag lending has changed forever. We can help you navigate these changes to build a successful, sustainable future. Schedule a demo today!